It’s unbelievable at first that these people could squander millions and billions of dollars but unfortunately, it does happen. There are a lot of rich people who made it to the peak of financial success, only to file bankruptcy later on and face mounting debts. On this gallery, we probe into the riches-to-rags lives of the (formerly) wealthy people. How did they attain their fortune and how did they lose it? Fortunately, some of them were able to recover from their dire financial woes.

Alberto Vilar is a Cuban-American businessman and philanthropist who was known as a generous patron of the arts (especially opera) and education. During the late 1970s, Vilar established Amerindo, an investment company, along with business partner Gary Tanaka. Vilar seemed to be at the top of the world when his assets reached over $1 billion in 2001. However, the stock market crash and Vilar’s own misdemeanors (like money laundering and investment advisor fraud) led to his own downfall. In November 2008 he was tried and convicted, and in February 2010 he was sentenced to nine years in prison.

It’s alleged that some of the money Vilar stole from his clients was used to cover his huge public philanthropic obligations.

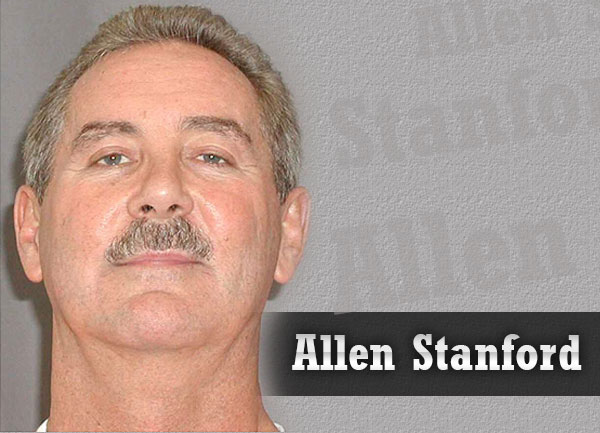

Allen Stanford made his fortune during the 1980s when he, together with his business partner father, bought up depressed real estate and sold it several years later when the market recuperated. Stanford also became a chairman of the now-defunct Stanford Financial Group of Companies.

However, Stanford was also a notorious fraud. His investment firm was alleged to be a massive Ponzi scheme, which stole money from his investors just to feed his lavish lifestyle. The entire scheme itself involved $7 billion in certificates of deposits. In 2012 he was convicted of all charges except one count of wire fraud. Today, Stanford is serving a 110-year prison sentence.

During his 19-year career as a Major League Baseball pitcher, Curt Schilling became $114 million richer. Following his retirement, he founded a video-game company which collapsed and cost him nearly all of his net worth — $50 million. Then he lost his entire fortune when the company filed for bankruptcy in 2012. The financial troubles forced him to sell several of his possessions.

As if his trials never seemed to end, Schilling also had an eight-month battle with cancer, but he successfully overcame it. Following his remission, he became an analyst for ESPN in 2014.

One of the iconic musical figures of the 1980s, Cyndi Lauper actually had a difficult beginning in her music career.

Lauper was the lead singer of the band named Blue Angel; they released their self-titled debut album on Polydor Records. Although a critical darling, it otherwise became a commercial disaster. Their album’s failure led the group to fire their manager, and also forced Lauper to file bankruptcy. Lauper worked at clubs and retail stores before releasing her debut solo album She’s So Unusual in 1983. It became a huge hit and catapulted Lauper into a pop star.

Former NBA player Dennis Rodman made a lot of money during his heyday. Aside from his salary of $27 million, he also earned more from his endorsement deals.

Following his retirement though, Rodman changed from an NBA star to someone who was now struggling to make ends meet. Because of this, he wound up in court for the $860,376 he owed to his third wife in child and spousal support.

Although the newly-retired boxer Floyd Mayweather may be one of the richest athletes around (having earned $100 million in 2014 alone), he was not spared from financial trouble. In 2009 he dodged from paying a $167,000 car loan. In 2012 he filed a claim of over $61 million in a local bankruptcy case. Two years later the IRS reported that he owed more than $50 million in back taxes, and he reportedly sought a lawyer to file for bankruptcy.

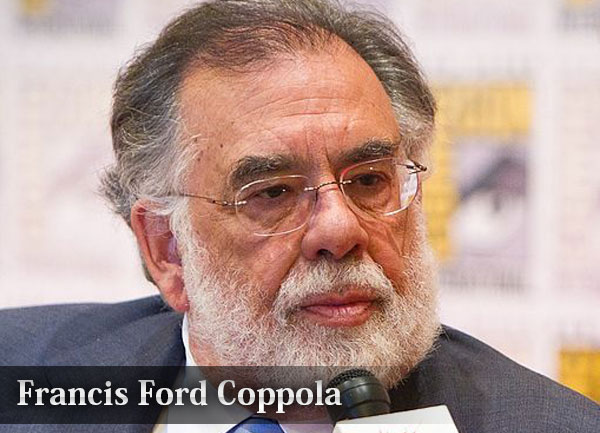

During the 1980s, renowned director and producer Francis Ford Coppola filed for bankruptcy following the box-office disaster of the musical “One from the Heart.” Because of this, he was forced to sell his Zoetrope Studio and would spend the remaining part of the decade working to pay off his huge debts. It was actually Coppola’s second time to file for bankruptcy protection.

He has since recovered from his financial woes. He is still active in films, and also operates several business ventures including a winery and several boutique hotels.

Kim Basinger filed for bankruptcy in 1993 after she backed down from filming “Boxing Helena,” resulting in an $8.1 million breach of contract. Three years later Basinger entered a new trial, where she ended up settling for $3.8 million.

As of 2013, Basinger has a net worth of $36 million.

Host Larry King once fell into bankruptcy during the 1960s, while he was a rising star on the radio as well as a newspaper columnist. He confessed that he was “flying high” at that time, but unfortunately, his life became a mess. He became knee-deep in debt (about $352,000 in unpaid bills) and worse, he was charged with grand larceny and of stealing $5,000 from a business partner. The charges were eventually dropped but that nightmare almost derailed King’s career. Fortunately, CNN saved King when it offered him a late-night talk show in Washington, D.C. in 1978. It would become the now-famous “Larry King Live,” a successful TV talk show that ran for over two decades.

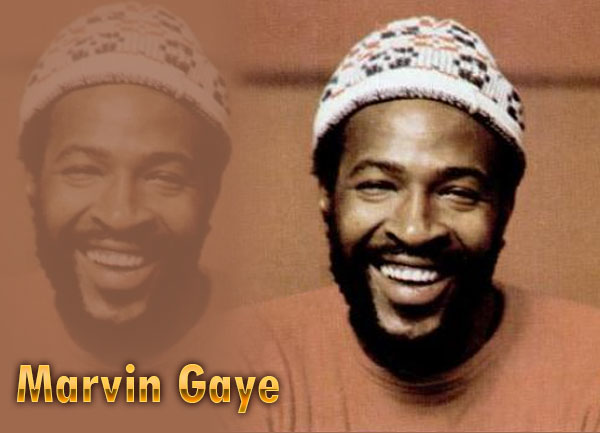

Marvin Gaye went bankrupt as a result of his divorce from his estranged first wife, Anna Gordy. He had to fulfill the overdue alimony payments by recording an album and giving his ex-wife $600,000 in royalties.

During his prime in the early 1990s, rapper MC Hammer commanded more than $30 million, but his excessive lifestyle eventually led him to bankruptcy. Not to mention two charges of infringement of copyright against him (which were both settled out of court for amounts not revealed to the public) led him to file for bankruptcy protection.

During the 1980s Meat Loaf was sued by Jim Steinman — who penned several of the artist’s tunes — following the moderate success of Meat Loaf’s album Dead Ringer. This incident led the singer to file for bankruptcy. He also met the same fate when his 1986 album Blind Before I Stop also met commercial failure.

Aside from his impulsive, uncontrollable spending, as well as charges of child abuse against him, brought him to the edge of bankruptcy. Jackson’s prosecutors would often take advantage of his financial mess as proof of guilt in his cases. When Jackson died in 2009 at age 50, he was still mired in debt. By the time he died he was working on a forthcoming tour which he hoped would help him recover his former glory.

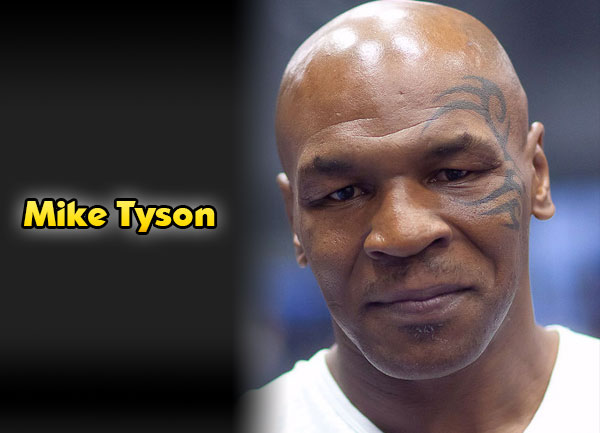

In a span of over two decades as a professional boxer Mike Tyson earned over an astonishing $400 million. However, all of this went virtually up in smoke when he faced heavy debts totaling $23 million, including a staggering $13.4 million he owed to the IRS.

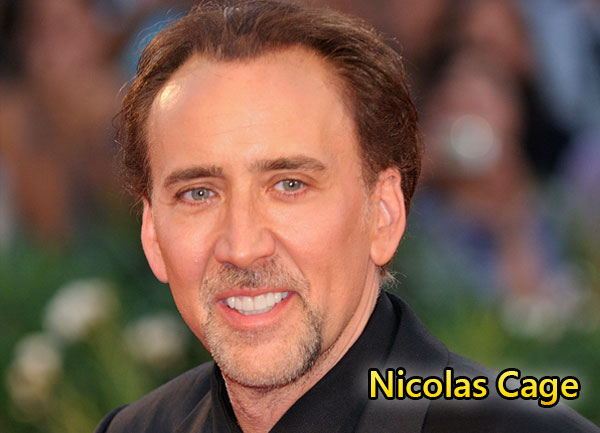

Nicolas Cage’s earnings from 1996 to 2011 amounted to $150 million. However, most of the money went down the drain because of his lavish lifestyle. In 2009 he owed $6.5 million in back taxes, which he is still paying up to now.

Patricia Kluge’s financial status after her divorce from media mogul John Kluge is uncertain. But there are some rumors that the settlement included a $1 million annual payment as well as assets that positioned her to have a net worth totaling about $1 billion.

But hosting lavish parties, foolhardy investment decisions, and bad timing caused most of her wealth to vanish. She wanted to enter into the winemaking business by turning her 900-acre estate into a vineyard. Unfortunately for Kluge, the 2008 global financial crisis hit the real estate industry and thus severely affected her winery ambitions. The property was foreclosed, and Kluge filed for bankruptcy. The vineyard was eventually bought by Donald Trump.

Like Patricia Kluge, Sean Quinn was also the victim of the 2008 financial meltdown. The Irish businessman and owner of the Quinn Group were once listed on the Forbes billionaire’s list and his personal worth amounted to $6 billion. However, he met his unfortunate financial fate after he loaned money from the Anglo Irish Bank to make a 25% investment on the latter. But the crisis hit him hard and worse, Anglo Irish Bank was nationalized. These factors sent his shares plummeting. The financial disaster led Quinn with a reported $3.85 billion debt to the Irish Bank Resolution Corporation, Anglo Bank’s successor.

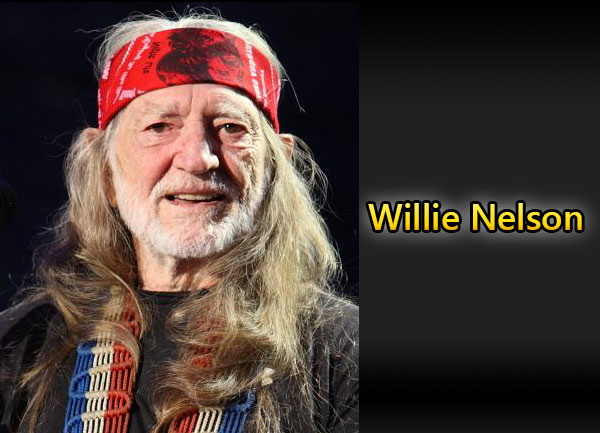

During the 1980s, the country legend was mired in financial trouble after IRS agents discovered he entered into a tax shelter that they had ruled as illegal. This forced him to lose virtually all of his assets, and even though his lawyer managed to re-negotiate the amount down to $6 million, Nelson still wasn’t able to pay it off. He shunned his obligations instead, which led the IRS to raid his ranch in Texas and seized everything except his cherished guitar.

Nelson eventually agreed to a deal with the IRS that some of the revenues from his album, appropriately titled The IRS Tapes: Who’ll Buy My Memories would go to his unpaid taxes. In 1993 Nelson was completely debt-free. He has since continued to be active in recording and performing.