The term “lease” in the real estate sector is very ambiguous. This is why landlords, tenants, real estate attorneys, realtors, and anyone else that uses the term need to be very specific. This is especially because there are various kinds of net leases and they imply different things.

Double, Single, and Triple net leases are the very common options and you are advised to know as much as possible about them. This is so that you understand especially your financial obligations if/when you sign a lease agreement. This is either as a tenant or a landlord.

For better understanding, we strongly suggest that you understand the different types of net lease agreements as this will help a lot. However, this article will be more particular about explaining one of the options.

Here we will discuss the Triple Net Lease option. Considering that it is a very commonly used option among real estate firms, we strongly advise that you know more about it by reading through to the end of this article.

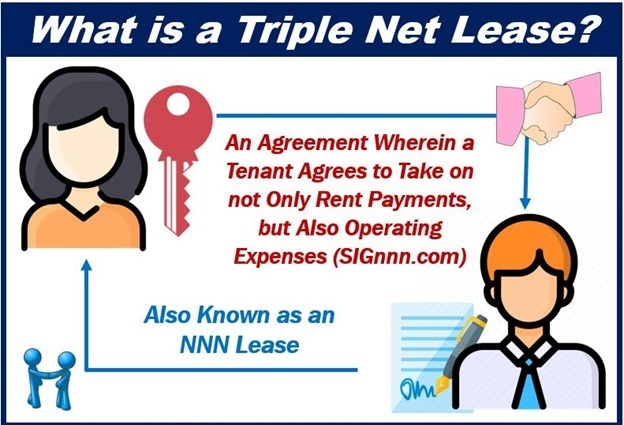

What Is Triple Net Lease?

This is a very common net lease structure that allows the tenant to assume most or all of the financial obligations of the landlord. This is because the tenant will be responsible for sorting out taxes, maintenance, and insurance subscription payment of the property. All these are aside from the conventional base rent charges expected from the tenant.

You should know that this option is not only referred to as Triple Net Lease. It could also be referred to as NNN as each N represents the financial obligations now expected of the tenant – Insurance subscription, property maintenance charges, and property taxes.

The Financial Implication of Signing a Net Lease Agreement

Tenants especially need to understand what they are getting themselves into before they put pen to paper. Although this kind of agreement usually means they pay a lot less in terms of base rental charges, it does not always mean it is a better deal.

This is because the financial costs as a result of taking up the financial obligations of the landlord could mean more spending. However, this is not always the case and this is why you need to understand all there is to know.

Be that as it may, the general financial implication of signing this agreement as a tenant means that you are responsible for paying taxes and insurance charges attached to the property. You are also responsible for maintenance and all these are in addition to the base rental charges.

The amount of financial involvement is dependent on what you have agreed. This is because it could be all or some of the responsibilities.

Frankly, it is a lot easier to figure out the financial implication when you consider your base rent charges, property taxes, and insurance subscription charges. However, the same cannot be said as regards the operating cost of the property.

Here we are not just talking about paying utility bills but what happens when you need to attend to certain repairs, replace things, and all that. This is why having a good idea of the state of the property is important before signing this agreement.

These will either help you see the need to turn down the triple net lease agreement offer or help you bargain better. And speaking of property maintenance costs, you should know that there are several things involved.

Some of them include trash removal, elevator maintenance, fire safety, security charges, maintenance of the parking lot, and janitorial services. Well, the financial implication especially as regards property maintenance is dependent on the kind of property you are getting.

This is why you cannot afford to turn a blind eye to the state of the property. You can see https://carr.us/triple-net-lease/ to know more about this.

But as a rule of thumb, older properties should be given more attention when inspecting their state. This is because of expected wear and tears and how this can affect the cost of being a tenant under the Triple Net lease agreement structure.

Making the Most of a Real Estate Attorney

We strongly advise that you do not get a property that is run using this lease structure all on your own. This is because there are certain things drafted in the agreement that may not be in your favor.

The agreements are even more favorable for the property owners for the most part. This is because it is drafted by their attorneys and designed to help them get a steady income from the property. The sad news is that this could be at your expense.

So, you should not get a property that uses this lease agreement system without the thorough guidance of your real estate attorney. This legal professional will help you realize if getting the property is a good deal.

This legal practitioner will also make appropriate changes to the drafted agreement and help you with bargaining (if the property is worth it). For more on what this professional can offer, you can read this.

Conclusion

Many tenants end up with regrets along the line because of their financial obligations aside from base rent charges and utility bills. Well, they would have made better decisions if they understood how the kinds of net lease agreements worked.

We have shed light on one of the net lease agreements here in our bid to help you make the right decisions. Above all, we strongly recommend that you do not take real estate decisions alone even as a tenant. You are advised to hire a capable real estate attorney to help out.